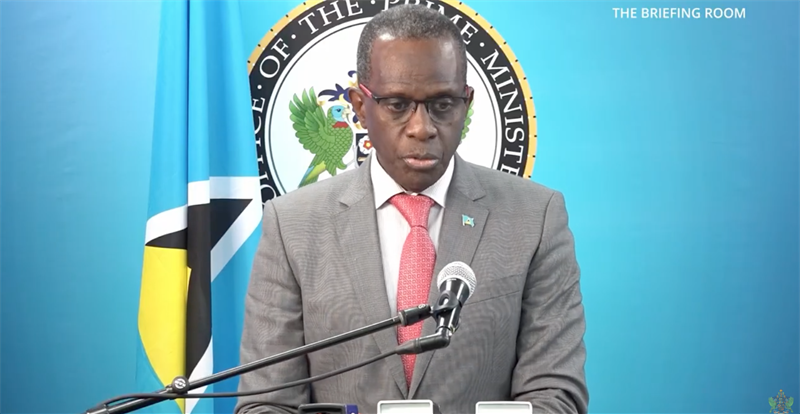

PRIME MINISTER HON. PHILIP J. PIERRE HOPES TO CUSHION THE EFFECT OF GLOBAL INFLATION ON LOCAL CONSUMERS.

Prime Minister Hon. Philip J Pierre has endeavored to explain in detail, how the removal of the 12.5 percent import levy of Value Added Tax will result in reductions in the cost of selected food items. The Government of Saint Lucia hopes that the year-long reprieve will cushion the effect of global inflation on local consumers.

Prime Minister Hon. Philip J Pierre has endeavored to explain in detail, how the removal of the 12.5 percent import levy of Value Added Tax will result in reductions in the cost of selected food items. The Government of Saint Lucia hopes that the year-long reprieve will cushion the effect of global inflation on local consumers.

“Saint Lucia imports $568M worth of food," said the Hon. Prime Minister. "We are price takers we do not control the cost of food bought outside Saint Lucia. What we do have, is jurisdiction over is the [selling] price. How does this work? Normally there are three charges on food imported into the country. There is an import duty, there is value added tax, and there is a service charge."

The Government of Saint Lucia intends to exercise its jurisdiction over these food import charges, by removing value added taxes on up to 70 everyday food items, with 45 standard-rated food items expected to show an automatic 12.5 percent reduction in prices following the application of new legislation that is expected to be passed in July. Previously, on June 1, a 6 percent service charge was also removed on 24 price-controlled food items.

“Out of the 70 items, 25 of these items are VAT exempt and 45 of these times are standard-rated. That means on 45 of those items, 12.5 percent VAT is paid. Another 24 of these 70 items are price controlled. What occurs now is that we are removing the VAT on all of these 70 items. In summary, 70 food items will now be zero-rated. There will be no VAT paid on these 70 items. Some were VAT exempt, and some were standard rated. Now, all of those 70 food items will be zero rated so there will be no VAT paid on them. The government has kept its promise and we expect to see a change in the price of goods at the supermarkets."

The Prime Minister added that the government has put monitoring mechanisms in place to ensure that the waiver of import duties on these 70 food items will redound to the benefit of consumers. The shortfall in revenue from these tax cuts, is expected to be recovered as the economy expands.

“The economy is expanding. We expect that there will be a lot more money in circulation," he explained. "Unemployment is in decline: there will be 1000 rooms built on the Rodney Bay strip so we expect more employment; Secrets opened last week; there is more employment at the A’ila construction site; and there are housing developments that will be started at Talvern and Rock Hall so people will be working there. Consequently, we expect there to be expansion to the economy and from there we expect to incur revenue."

The changes in the legislation on VAT will be made effective on July 1. A termination date will be announced.

Watch video news report: https://www.youtube.com/watch?v=EQ-qdzUwSD8