HE SAID THE OBJECTIVE OF THE FUND SHOULD BE TO GROW WEALTH ACROSS A BROAD DEMOGRAPHIC.

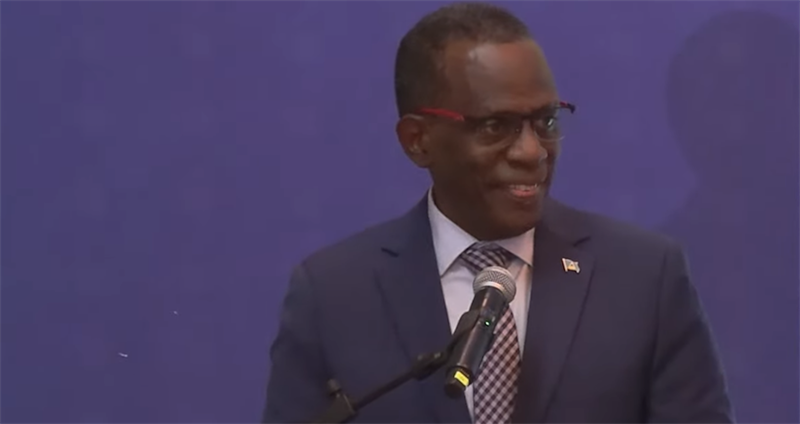

Prime Minister Philip J. Pierre has praised the Bank of Saint Lucia’s Global Investment Fund, and committed government’s support to the bank’s newest financial service.

Prime Minister Philip J. Pierre has praised the Bank of Saint Lucia’s Global Investment Fund, and committed government’s support to the bank’s newest financial service.

On January 28, Bank of Saint Lucia launched a global investment fund, offering new investment opportunities to its customers.

In an address at the launching, Prime Minister Pierre said the fund will provide opportunities to deepen investment management, and must be seen to grow wealth across a broad socio-economic area.

“In Saint Lucia the opportunities for investment are limited within the context of a relatively low savings interest rate environment in the commercial banking sector. We have seen increased demand for other investment vehicles. It is evident that mutual funds can fill that void and provide options for many as youth investors. However, you must ensure that the opportunities that mutual funds offer are not seen to be to be within the reach of only the very wealthy; we must market and promote the fund as being widely accessible to the general populace. Our aim should be to build capacity and grow wealth across a broad demographic area.”

The prime minister praised the robust regulatory framework that governs the fund. He cautioned that regulation should reflect the Caribbean’s financial landscape.

“The government’s support for the Bank of Saint Lucia - Global Investment Fund is also based on a robust regulatory framework that underpins the operation of the fund,” he said. “The Eastern Caribbean Security Regulatory Commission continues supervised and strong oversight. We hold steadfast to the view that while the best practices must prevail the regulatory environments must reflect our unique circumstances and be tailored to the realities of our Caribbean civilization. Our financial landscape regulation must not be a disincentive but instead a tool for sustainable growth.”

According to the prime minister, the launch of the Global Investment Fund is expected to drive efficiency, spur innovation, lower transaction costs and provide increased investment options.